You can also access several self-service forms to take care of business on your own.

Credit Cards

- Turn your card off and report it as lost or stolen using Online or Mobile Banking1. Simply log in, click on "Manage Cards" in Online Banking or "Cards" in Mobile Banking1. You may be prompted to call us.

- Call Cardholder Services at (800) 472-3272.

- Visit a financial center to receive a card instantly issued.

For lost or stolen credit cards, please choose from the following options:

- Turn your card off/on and report it as lost or stolen using Online or Mobile Banking1. Simply log in, click on "Manage Cards" in Online Banking or "Cards" in Mobile Banking, and follow the prompts to close your credit card and request a new one.

- Or for your Mastercard® Platinum or Mastercard® Cash Rewards credit cards, please call (855) 325-0904. For your Mastercard® World credit card, call (855) 510-4594.

- Please call (866) 394-1205 during business hours and a dispute expert will help you file a claim.

- Log into Online Banking, click on your credit card account, and select "dispute" next to the applicable transaction.

- Or to file a claim via phone for your Mastercard® Platinum or Mastercard® Cash Rewards credit cards, please call (855) 325-0904. For your Mastercard® World credit card, please call (855) 510-4594 to file a claim.

- For all other disputes:

Visit a local Financial Center.

Call our Contact Center at (800) 845-0432.

- Log in to Online or Mobile Banking1 to transfer a payment.

- Mail a payment to us.

- Make payments at a financial center through a:

- Personal check

- Certified check or money order

- Cash, or

- Contact us to make a payment by phone.

- Log into Online Banking.

- Click on your credit card.

- Click on "Statements."

- Select the toggle button to turn on paperless statements.

- To register your debit card, visit uChoose Rewards and follow the registration steps.

- To register your credit card, simply click on the uChoose Rewards icon on the credit card page in Online Banking and follow the registration steps.

Account Information

Appointments

To reschedule your appointment for a different date or time, new appointment type, or a different Financial Center, please cancel your existing appointment and schedule a new one.

We want to make sure you have an outstanding experience with your appointment. To do that, we ask that appointments are scheduled at least one hour in advance to give our representatives an opportunity to prepare for your appointment. If your need is more urgent, please call us or visit any one of our Financial Centers and we would be happy to help you. Members without an appointment are served on a first-come first-served basis.

Yes. Any one of our Financial Centers would be happy to help you. Members without an appointment are served on a first-come first-served basis.

Look for an email confirmation and text message if you selected "SMS Text Alerts".

For each of our appointments, we block out 30 minutes or an hour especially for you. Most appointments last 30-45 minutes.

Auto Loans

For all loan requests you will be asked to provide personal information:

- Name of each applicant

- Physical address (P.O. Box does not apply)

- Length of time at address

- Phone number

- E-mail address

- Social Security number

- Date of birth

- Income information

- Name of current employer

- Employer's address and phone number

- Length of employment

- Salary

- Position held

- Other applicable income (for example, retirement and/or pension)

- Current mortgage or rent obligations

- Name and phone number of nearest relative not living with you

- Loan application purpose

- Collateral information, if applicable.

To apply now, get started with an online loan inquiry, visit a local financial center or contact us.

Click here to learn more about auto insurance available through our wholly-owned subsidiary, South Carolina Federal Insurance Solutions.

Business Checking

To register your MasterCard® Business Debit Card, visit uchooserewards.com and follow the registration steps using the last four digits of the EIN/TIN. If you have already earned points, you will see your totals. Points are posted between the 15th and the 25th of the following month.

MasterCard® Debit cardholders earn 1 uChoose Rewards point for every $5 on all signature-based transactions. Mastercard® Business Credit cardholders earn 1 uChoose Rewards point for every $1 on all transactions. Each debit or credit card on the business account will receive points for transactions.

Points can be redeemed at uchooserewards.com for up to 5 years from the date of purchase.

We have partnered with Clover® Business Solutions to give our member’s the ability to accept debit and credit cards as forms of payment. Funds are deposited directly into the business checking account within 72 hours of the transaction. All major cards are accepted.

Please Contact us to get started and a Clover® representative will contact you regarding your application and answer any additional questions you may have.

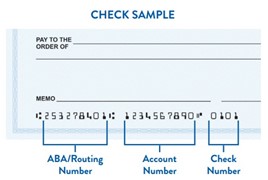

If this is your first time placing an order for checks, please give us a call at (800) 845-0432. You will need to have the ABA/Routing Transit number ready (253278401). For check reorders, be sure to have the complete checking account number.

If this is your first time placing an ordering checks, please these steps:

If you do not have your log in credentials or need help logging in, please contact us at (800) 845-0432.

Business Credit and Debit Cards

To register your MasterCard® Business Debit Card, visit uchooserewards.com and follow the registration steps using the last four digits of the EIN/TIN. If you have already earned points, you will see your totals. Points are posted between the 15th and the 25th of the following month.

MasterCard® Debit cardholders earn 1 uChoose Rewards point for every $5 on all signature-based transactions. Mastercard® Business Credit cardholders earn 1 uChoose Rewards point for every $1 on all transactions. Each debit or credit card on the business account will receive points for transactions.

Points can be redeemed at uchooserewards.com for up to 5 years from the date of purchase.

- Visit uChooserewards.com.

- Select the “Merchandise” link to view the merchandise catalog.

- Add the desired merchandise awards to your shopping cart for redemption.

- Click on the "Proceed to Checkout" button to place your order online.

- Enter your name, shipping address, and a telephone number, and click "Transmit Order" to submit your order.

- You will receive a confirmation number after your order has been submitted.

Keep records of your order until you receive your award merchandise. Points can be redeemed for travel awards online or via phone.

Travel awards that can be redeemed through the uChoose Rewards Travel Agency include:

- Airline tickets

- Hotel certificates

- Car certificates

- Vacation packages

- Experiences

- Cruises

Business Loans

Loan payment due dates are generally 30-45 days from the loan closing date. The payment due date is notated in your loan documents and agreed upon before disbursement of your loan. Due dates and loan payment amounts can also be viewed through Online Banking, Mobile Banking or statements.

Business Share Certificates

We offer certificates, available on business accounts:

-

Regular certificates are opened with a minimum of $500.

-

Jumbo certificates are opened with a minimum of $50,000.

-

Terms range from 3 months to 60 months.

-

Rates are subject to change at any time and vary based on your balance and term.

To open a certificate now, visit a local financial center or contact us.

We offer ability to:

-

View transaction history to include; balances, deposits, cleared checks or dividends.

-

Track spending and download transactions to Quick Books.

-

Make loan payment.

-

Conduct account research.

-

Apply stop payments.

-

Allow multiple users within a company to have assigned levels of access and authority.

-

Conduct wire transfers for members who qualify.

-

Send ACH payments for Business Members who qualify (direct debit/credit to other accounts).

-

Schedule transfers.

-

Pay Bills.

Checking and Savings Accounts

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking.1

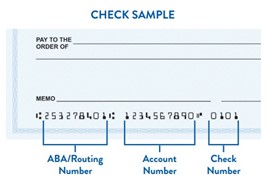

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

account number and South Carolina Federal's routing number.

South Carolina Federal's routing (MICR) number is 253278401. Your account number is the second string of characters at the bottom left of your check. You can also locate your account number by clicking on the eye icon within Online or Mobile Banking.1

If this is not your first time ordering checks, follow these steps:

- Log into Online Banking.

- Click on one of your accounts.

- Click on "More Actions."

- Click on "Order Checks."

- Click "Continue."

- Follow the remaining steps.

Here are some tools to help you stay on top of your finances and avoid overdrafts:

-

Budget: Check out our budgeting tips here to help you make better financial decisions.

-

Enroll in Direct Deposit: Direct Deposit lets you receive your paychecks faster and helps ensure you have the money you need, when you need it.

-

Enroll in Online Banking: Check your balances and account history, schedule transfers, receive mobile account alerts and deposit checks through Remote Deposit; all through the convenience of Online Banking.

Digital Wallet

Loans

For all loan requests you will be asked to provide personal information:

- Name of each applicant

- Physical address (P.O. Box does not apply)

- Length of time at address

- Phone number

- E-mail address

- Social Security number

- Date of birth

- Income information

- Name of current employer

- Employer's address and phone number

- Length of employment

- Salary

- Position held

- Other applicable income (for example, retirement and/or pension)

- Current mortgage or rent obligations

- Name and phone number of nearest relative not living with you

- Reason for loan application

To apply now, get started with an online loan inquiry, visit a local financial center or contact us.

Loan payment due dates are generally 30-45 days from the loan closing date. The payment due date is notated in your loan documents and agreed upon before disbursement of your loan. Due dates and loan payment amounts can also be viewed through Online Banking, Mobile Banking or statements.

A payoff quote is available for all loans and will include accrued interest and the daily per diem.

To obtain today's payoff or a 10 business day payoff quote for auto, boat, recreational vehicle, credit cards, or personal loans, visit a financial center or contact us. Any overage of your payoff will be deposited into your savings account or returned to you in an overpayment check.

For first mortgages, please contact Dovenmuehle at (877) 636-9534.

For second mortgages/HELOCs, please visit a financial center or fax your payoff request to our Fulfillment Operations Team at (843) 737-7400. The request must include:

- Member name

- Member Social Security number

- Account number

- Payoff (good through) date

- Return fax number

- Copy of a signed authorization of release form from member requesting this information.

Once payoff is given, personal access line of credit loans and HELOCs will be locked and no advances can be taken.

Our loans are calculated with simple interest, the calculation of daily accrued interest on your principal loan balance.

Simple interest is calculated and assessed by multiplying the account’s current principal amount (and only the principal) by the interest rate. But as you pay down your principal with each monthly on-time payment, that principal decreases, lessening the interest assessed. If you pay more than the minimum required payment, the principal will decrease even more.

For example, a $25,000 loan at a 7% interest rate would be calculated using the formula (Principal Balance x rate)/ 365 days:

- $25,000 x 7% = $1,750

- $1,750/365 days = $4.80 per day

Manage Your Cards

- Turn your card off and report it as lost or stolen using Online or Mobile Banking1. Simply log in, click on "Manage Cards" in Online Banking or "Cards" in Mobile Banking1. You may be prompted to call us.

- Call Cardholder Services at (800) 472-3272.

- Visit a financial center to receive a card instantly issued.

For lost or stolen credit cards, please choose from the following options:

- Turn your card off/on and report it as lost or stolen using Online or Mobile Banking1. Simply log in, click on "Manage Cards" in Online Banking or "Cards" in Mobile Banking, and follow the prompts to close your credit card and request a new one.

- Or for your Mastercard® Platinum or Mastercard® Cash Rewards credit cards, please call (855) 325-0904. For your Mastercard® World credit card, call (855) 510-4594.

For debit card disputes:

- Please call (866) 394-1205 during business hours and a dispute expert will help you file a claim.

For credit card disputes, please choose from the following options:

- Log into Online Banking, click on your credit card account, and select "dispute" next to the applicable transaction.

- Or to file a claim via phone for your Mastercard® Platinum or Mastercard® Cash Rewards credit cards, please call (855) 325-0904. For your Mastercard® World credit card, please call (855) 510-4594 to file a claim.

- For all other disputes:

Visit a local Financial Center.

Call our Contact Center at (800) 845-0432.

- Log into Online or Mobile Banking1.

- Click on "Manage Cards" in Online Banking or "Cards" in Mobile Banking.

- Select "Manage Travel Plans."

- Click on "Manage card."

- Click on "Replace card."

- Click on "Cards."

- Click on "Replace card."

My CreditScore

It also monitors your credit report daily and informs you by email if there are any big changes detected, such as a new account being opened, a change in address or employment, a delinquency has been reported, or an inquiry has been made.

No. Checking your credit score is a soft inquiry, which does not affect your credit score. Lenders use hard inquiries to make decisions about your credit worthiness when you apply for loans.

No. Accessing your credit score is free, and no credit card information is required to register.

Yes; it will monitor and send email alerts when there’s been a change to your credit profile.

If you change your email address in Online Banking, My Credit Score automatically updates your email on its side as well. However, we always encourage you to inform South Carolina Federal of any changes to your contact information.

New Website

No. Our Online Banking platform and mobile app remain the same.

The Online Banking login remains at the top of every page; you will now find it in the righthand corner. It is a button that will display login fields after you click "log in," and you will enter your same login credentials to access your accounts.

As times and technology change, we want to ensure our website supports your needs and provides an optimal online experience. The new website reinforces our continued commitment to helping our members improve their financial condition while providing enhanced tools and features we know you will love.

Yes. We designed our new website with your mobile experience top of mind, and it is optimized for your tablet and smartphone.

Online and Mobile Banking

To sign up for Online Banking, click on "Login" at the top of the screen, then click on "First Time User", and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Caroline Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

- Click on "Settings."

- Click on "Profile."

- Click on "User ID."

- Enter your new User ID.

- Confirm your new User ID.

- Click "Save."

- Click on "Settings."

- Click on "Profile."

- Click on "Password."

- Enter your current password.

- Enter your new password.

- Confirm your new password.

- Click "Save."

- Click on "More."

- Click on "Change password."

- Follow the prompts.

Scholarship

Applicants are also required to have a GPA of at least 3.0 and be a legal resident of the United States.

Graduate students are not eligible to apply.

Each application is evaluated based on financial need, academic success, volunteer experience, the essay, and a written recommendation.

Text Banking

- BAL = Account balances

- HIST + texting nickname (ex. HIST Checking) = Account history

- STOP = Cancel

- HELP = Help on keywords

Zelle®

Zelle®Zelle® is a great way to send money to family, friends, and people you are familiar with such as your personal trainer, babysitter, or neighbor.1

Since money is sent directly from your South Carolina Federal account to another person's bank account within minutes3, Zelle® should only be used to send money to friends, family, and others you trust.

If you don't know the person or aren't sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle®. These transactions are potentially high risk (just like sending cash to a person you don't know is high risk).

Neither South Carolina Federal nor Zelle® offers a protection program for any authorized payments made with Zelle® for example, if you do not receive the item you paid for or the item is not as described or as you expected.

- To get started, navigate to "Pay Bills" in Online Banking or "Transfer and Pay" in Mobile Banking and select "Send Money with Zelle®". Accept terms and conditions, enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it, and you are ready to start sending and receiving with Zelle®.

- To send money using Zelle®, simply add a trusted recipient's email address or U.S. mobile phone number, enter the amount you would like to send and an optional note, review, then hit "Send." In most cases, the money is available to your recipient in minutes³.

- To request money using Zelle®, choose "Request," select the individual(s) from whom you would like to request money, enter the amount you would like to request, include an optional note, review and hit "Request"2.

- To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®.

If you have not yet enrolled with Zelle®, follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select South Carolina Federal.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification - you should enroll with Zelle® using that email address or U.S. mobile number where you received the notification to ensure you receive your money.

Since money is sent directly from your bank account to another person's bank account within minutes³, Zelle® should only be used to send money to friends, family and others you trust.

Neither South Carolina Federal nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.