Get everything you need - and a lot more on top of that.

Some checking accounts reach into your pocket for monthly fees. At South Carolina Federal Credit Union, our Premium Checking does just the opposite. We hand you opportunities to earn extra money and valuable rewards while providing all the tools needed to manage your finances efficiently.

- Premium Share Certificates available.

- Discounted vehicle loan rates.*

- Instant issue debit card for easier shopping online or in stores.

- Earn points every time you choose "credit" for your debit card purchases, and go shopping on uChoose Rewards®.

- Access your accounts through a nationwide ATM network.

- Free foreign ATM use.

- Priority member service over the phone.

- $20 discount on yearly rentals of safe deposit boxes.

Avoiding Fees

The monthly fee is waived as long as you maintain an average daily balance1 of $2,500 in your Premium Checking account, or a month-end balance of $5,000 in combined share accounts (savings, checking and Money Market), plus one of the following monthly:

- Monthly direct deposit of at least a single amount of $2502 or more and 10 signature-based debit card transactions.

- A current first mortgage with South Carolina Federal Credit Union.

- Monthly direct deposit of at least a single amount of $2502 or more and an open South Carolina Federal Credit Union Mastercard credit card.4

- Month-end loan balance3 of $15,000 or more.

| From | To | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|---|

| $2,500.00 | $9,999.99 | 0.05% | 0.05% |

| $10,000.00 | or more | 0.10% | 0.10% |

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

- Make an Appointment and What to Bring Information

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking.1

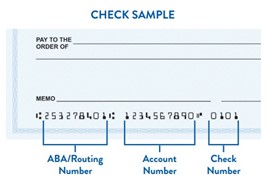

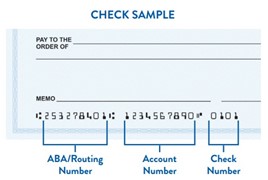

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

South Carolina Federal's routing (MICR) number is 253278401. Your account number is the second string of characters at the bottom left of your check. You can also locate your account number by clicking on the eye icon within Online or Mobile Banking.

If this is not your first time ordering checks, follow these steps:

- Log into Online Banking.1

- Click on one of your accounts.

- Click on "More Actions."

- Click on "Order Checks."

- Click "Continue."

- Follow the remaining steps.

Here are some tools to help you stay on top of your finances and avoid overdrafts:

-

Budget: Check out our budgeting tips to help you make better financial decisions.

-

Enroll in Direct Deposit: Direct Deposit lets you receive your paychecks faster and helps ensure you have the money you need, when you need it.

-

Enroll in Online Banking1: Check your balances and account history, schedule transfers, receive mobile account alerts and deposit checks through Remote Deposit; all through the convenience of Online Banking.