Your country thanks you. And we do, too.

Being active-duty military often means making sacrifices - frequent moves, time away from family, difficult deployments. At South Carolina Federal Credit Union, we feel it is time you were rewarded for your courage and commitment. By simply presenting your active-duty* military ID, you receive a Premium Checking account with a wide range of benefits.

- Monthly Premium Checking fee waived.

- Tiered dividend payments starting at $2,500.**

- Premium Share Certificates available.

- 0.50% APR*** discount on vehicle loan rates.

- Debit Card uChoose Rewards program access to earn points every time you choose “credit” for purchases with your debit card.

- Priority member service over the phone.

- $20 per year discount on any size safe deposit box.

- Free Instant issue debit card, with a variety of colors to choose from.

- Free international ATM use (no charge from us - surcharges from ATM owner may apply).

- Free cashier's checks.

| From | To | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|---|

| $2,500.00 | $9,999.99 | 0.05% | 0.05% |

| $10,000.00 | or more | 0.10% | 0.10% |

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking.1

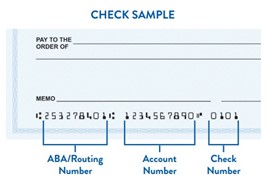

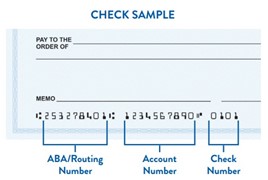

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

account number and South Carolina Federal's routing number.

South Carolina Federal's routing (MICR) number is 253278401. Your account number is the second string of characters at the bottom left of your check. You can also locate your account number by clicking on the eye icon within Online or Mobile Banking.1

If this is not your first time ordering checks, follow these steps:

- Log into Online Banking.1

- Click on one of your accounts.

- Click on "More Actions."

- Click on "Order Checks."

- Click "Continue."

- Follow the remaining steps.

Here are some tools to help you stay on top of your finances and avoid overdrafts:

-

Budget: Check out our budgeting tips to help you make better financial decisions.

-

Enroll in Direct Deposit: Direct Deposit lets you receive your paychecks faster and helps ensure you have the money you need, when you need it.

-

Enroll in Online Banking1: Check your balances and account history, schedule transfers, receive mobile account alerts and deposit checks through Remote Deposit; all through the convenience of Online Banking.

Military benefits are valid for three years and can be renewed every three years by presenting military ID or proof of active duty service.