Jolly holidays start with a four-season savings plan.

Money for gifts - and more

Make as many deposits as you wish to build up your Christmas season budget.

Earn competitive dividends

Keep at least $5 in your account and we will add to the merriment with regular payments.

Track your progress

Balances appear on monthly statements, viewable in Online and Mobile Banking.

There when needed

Four free withdrawals during the year. ($5 for each additional withdrawal)

Bring more joy to the world of the people you care about with this savings account.

Everything that makes your family smile at Christmastime is worth saving for year-round. Our Christmas Club account helps you set aside cash for nice presents, festive meals, and heart-warming gatherings of family and friends. We automatically move your money to your Share Savings account on November 1 – just in time for the holiday shopping season.- $5 opening deposit.

- No minimum balance fee.

Effective Date: May 21, 2024

| Account Type | Minimum Balance to Earn Dividends | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|---|

| Share Savings | $150.00 | 0.10% | 0.10% |

| Christmas Club | $5.00 | 0.10% | 0.10% |

| IRA Savings | $100.00 | 0.20% | 0.20% |

Get in the savings spirit.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking.1

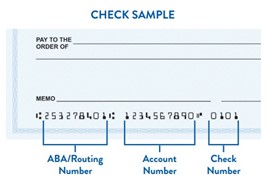

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

To sign up for Online Banking, click on "Login" at the top of the screen, then click on "First Time User," and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

If you have registered for Online Banking1, you are automatically enrolled in eStatements.