Youth savings accounts help develop good money management skills.

Encourage positive habits

Setting aside money regularly helps you plan for the future.

Easy to get started

All it takes is $5 to open one of these accounts.

Build over time

Steady deposits grow with our rate.

Increase financial knowledge

Access age-appropriate financial literacy resources.

Three accounts are ideal for saving birthday money and income from first jobs.

From the crib through college, these youth savings accounts allow young members the opportunity to increase their savings while developing money management skills that last a lifetime.

MY Savings

- Designed uniquely for young adults ages 18 to 25.

- Manage your account through Online & Mobile Banking* (free service – check your cell phone plan for possible fees).

- Earn more dividends on the first $1,000 in this account.

- Look for financial education workshops we host at local colleges and financial centers.

Teen Savings

- A special account for teens ages 13 to 17 (a qualified adult joint owner is needed).

- Open this account in person with a qualified adult joint owner and bring an ID, such as a Social Security card.

- One form of government-issued photo identification. Photo identification must include:

- Picture

- Signature

- Issue date

- Expiration date

- Manage your account through Online & Mobile Banking* (free service – check your cell phone plan for possible fees).

- Start earning dividends on balances as low as $5.

- Look for financial education workshops we host at local schools and financial centers.

Kids Savings

- Tailored to children ages 12 and younger.

- Open this account in person with a qualified adult joint owner and bring an ID, such as a Social Security card.

- An official Kids Savings account statement arrives every quarter so your child can see how his or her money is growing.

- Start earning dividends on balances as low as $5.

- Receive a fun and informative quarterly newsletter that teaches the value of saving.

- Kids Savings members can participate in contests and are eligible to win prizes.

Here's what you'll need to open an account.

A tax identification number with proper ID for yourself and any minor (Social Security card or military ID) is required to establish the account. Teen Savings and Kids Savings members will need a qualified adult joint owner. If you are 14 years old and under, the minor is not required to have a photo ID.

Youth Savings Rates

Effective Date: April 4, 2024

| Minimum Balance to Earn Dividends | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|

| $5.00 | 0.10% | 0.10% |

Teen Savings Rates

Effective Date: April 4, 2024

| Minimum Balance to Earn Dividends | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|

| $5.00 | 0.10% | 0.10% |

MY Savings

Effective Date: April 4, 2024

| From | To | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|---|

| $0.01 | $1,000.00 | 1.10% | 1.11% |

| $1,000.01 | and up | 0.10% | 0.10% |

Open your Youth Savings account.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking.1

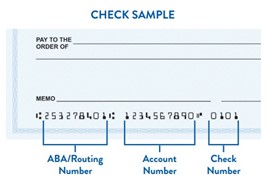

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

To sign up for Online Banking, click on "Login" at the top of the screen, then click on "First Time User," and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

If you have registered for Online Banking, you are automatically enrolled in eStatements.