Given some time, we can lift your savings to new heights.

Set your schedule

Choose a Share Certificate savings period that fits with your future financial plans.

Choose a starting point

It takes only $500 to open a Share Certificate, but you can go way beyond that.

Lock into a rate

The dividend rate is locked in for the term, allowing you to project your eventual earnings.

Feel secure

Deposits up to $250,000 are insured by the National Credit Union Administration.

Higher earnings are worth the wait.

A brilliant financial strategy is not required to grow your money. All it takes is a little patience. With our Share Certificates, you can choose to save for a few months, several years, or somewhere in between. When that time is up, you can walk away with a good deal more money than when you started.

- Requires a minimum deposit of $500.

- Choose Share Certificates ranging from three months to five years.

- Our 36-month Step-Up option lets you move to a higher dividend rate should rates rise during your Certificate term.

- In general, longer term certificates pay even higher rates.

- Share Certificates earn higher yields than most standard savings accounts.

- Earn even higher rates with Jumbo Share Certificates when you have over $50,000 more to invest.

Effective Date: May 21, 2024

| Term | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|

| 3 Months | 1.00% | 1.00% |

| 6 Months | 1.74% | 1.75% |

| 12 Months | 2.23% | 2.25% |

| 18 Months | 2.28% | 2.30% |

| 24 Months | 2.47% | 2.50% |

| 36 Months | 2.72% | 2.75% |

| 36 Months Step-Up | 2.62% | 2.65% |

| 60 Months | 3.93% | 4.00% |

Effective Date: May 21, 2024

| Term | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|

| 60 Month Premium ($500.00 Minimum Balance) | 4.02% | 4.09% |

Open your Share Certificate.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking.1

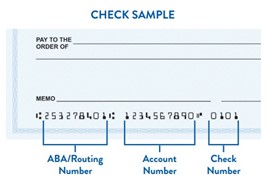

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

To sign up for Online Banking, click on "Login" at the top of the screen, then click on "First Time User," and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

If you have registered for Online Banking1, you are automatically enrolled in eStatements.

Embrace the elephant in the room: retirement planning.

South Carolina Federal Investment Solutions, through CFS*, can help you whether you are 25 or 65.